by Adam | Jul 14, 2025 | Blog

Providing a comprehensive group benefits plan is crucial for attracting and retaining top talent in Canada. However, the rising costs of healthcare and insurance premiums can put a significant strain on small and medium-sized businesses (SMEs). Fortunately, there are...

by Adam | Jul 14, 2025 | News

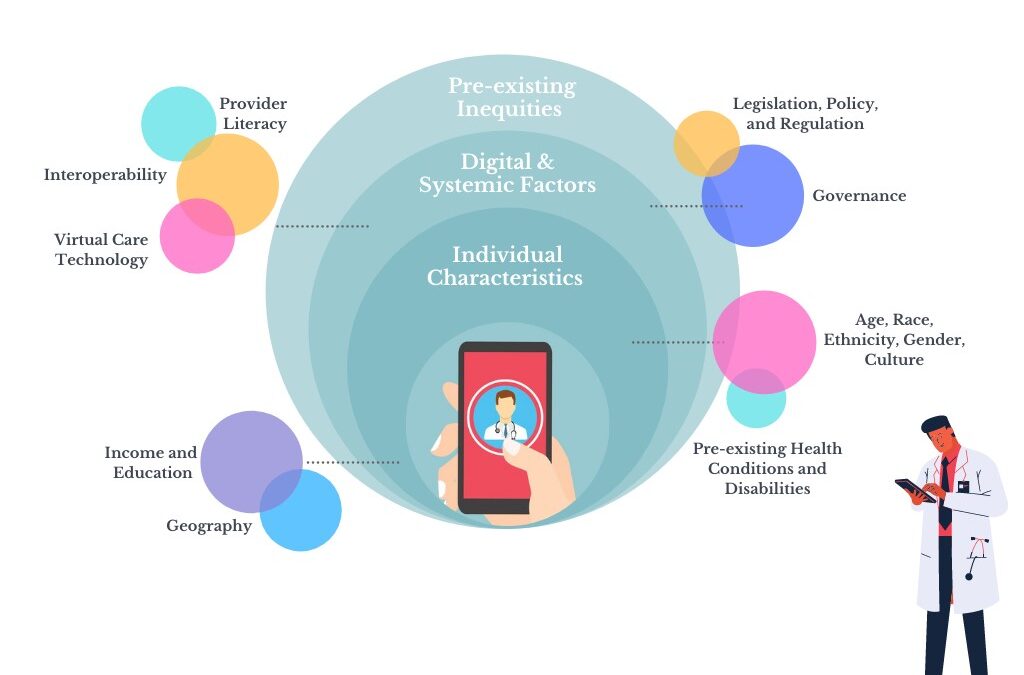

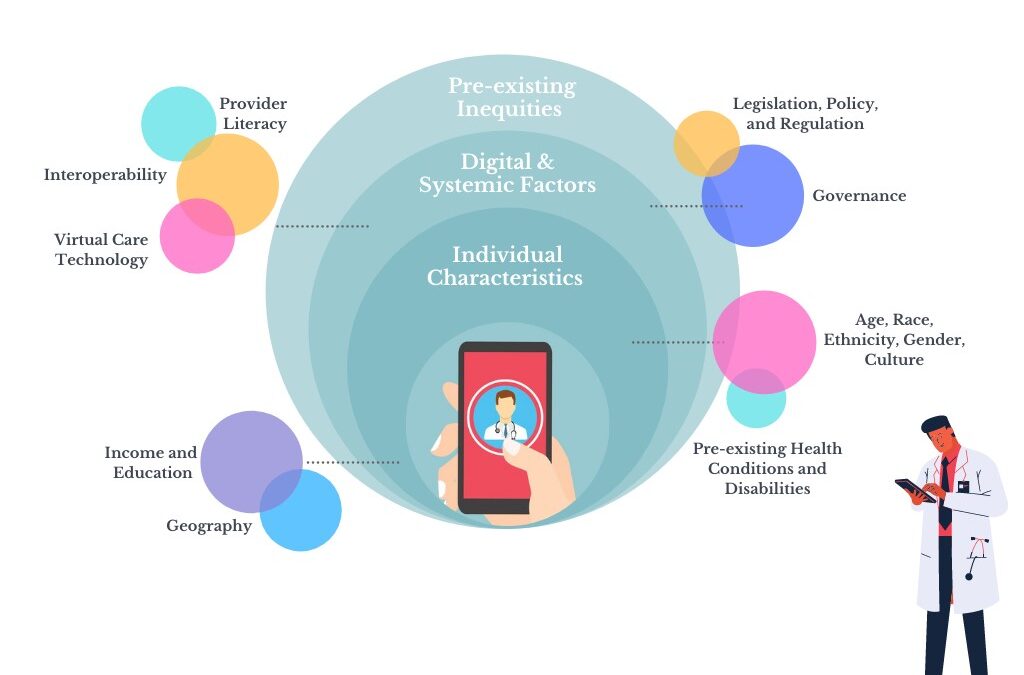

Navigating the Digital Health Landscape: Virtual Care in Your Group Benefits Plan In today’s fast-paced world, convenience and accessibility are king. This holds true not only for our daily lives but increasingly for how we access healthcare. The pandemic undeniably...

by Adam | Aug 16, 2016 | News

No longer will cannabis users be deemed smokers – at least not when it comes to applying for life insurance and critical illness insurance. Regardless of how the marijuana is imbibed – be it smoked, ingested or inhaled through a vaporizer – a number of major insurers...

by Adam | Jun 30, 2016 | News

Introducing a new way to reward your employees and support their wellness Trying to think of a way to give your employees a bonus or offer an incentive that isn’t cash? A Lifestyle Spending Account (LSA) offers an excellent means to not only promote a healthy...

by Adam | May 31, 2016 | News

Have questions about employee plans? We’ve got answers Let’s talk Group Benefits Plans. What? You don’t want to?! You say you find them confusing? You end up with more questions than answers? Not when you’re dealing with ADI Benefits! We’re all about offering...

by Adam | May 3, 2016 | News

Busting myths about Life, Critical Illness and Disability Insurance Having been in the insurance industry for years, I’ve heard more than my share of myths and misconceptions: I don’t need disability insurance, I get it through my work; life insurance is for old...

by Adam | Apr 15, 2016 | News

What you’re getting – and what you’re not – with your group benefits plan Quick! When you think group health options what comes to mind? Physios, chiros and dentists, maybe? But wait – there’s more. Today’s group benefit plans cover a multitude of products and...

by Adam | Feb 25, 2016 | News

If you’re a sole proprietor or have 10 or fewer employees, chances are you and your workers aren’t getting your money’s worth with a traditional employee benefits plan. Enter the Health Spending Account. Not only will an HSA be better utilized by employees, as a...

by Adam | Feb 5, 2016 | News

So you’ve decided to look into setting up an employee benefits plan (group benefits plan) for your business. This is a good thing! It shows your business is succeeding and you’re willing to invest in it and your employees. Then again, it might just mean you’re...

by Adam | Jan 2, 2016 | News

Most of us know we’re going to die. But did you know that 33% of Canadians will develop a life-threatening cancer? Or that 50% of heart attack victims are under 65 years old? Each year, 50,000 Canadians suffer a stroke, three-quarters of which result in a disability....